To assist you and your family plan your financial future is a key part of what we do.

The way we see our role in this to offer a plan to your financial future which may or may not end up in your requiring financial products to meet your goal. We want to spend the time with you to understand and help you realise the goals that you have.

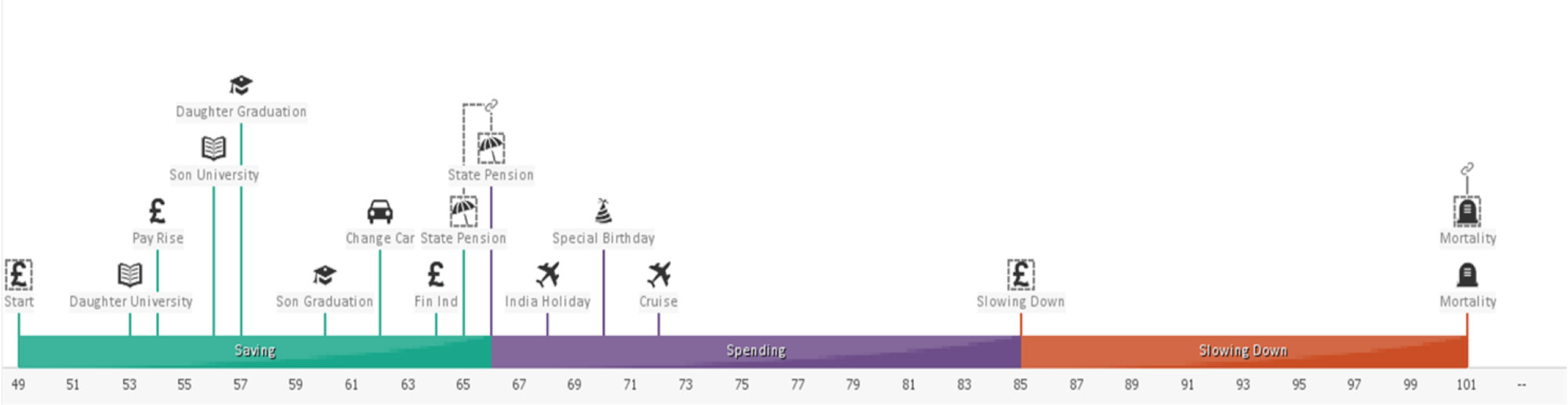

This will give you more certainty towards the key points in your life such as children’s university savings, children’s weddings, house deposits or even down to your own retirement. Take the stress and uncertainty out of your savings and organise your plan through a lifetime master plan.

We will work with you to help you build a master plan that sees you through life.

The Master Plan will be amended to your changing life and plans but as we meet we can adapt your plan, the changes you have experienced and rekey the numbers to see how that changes things.

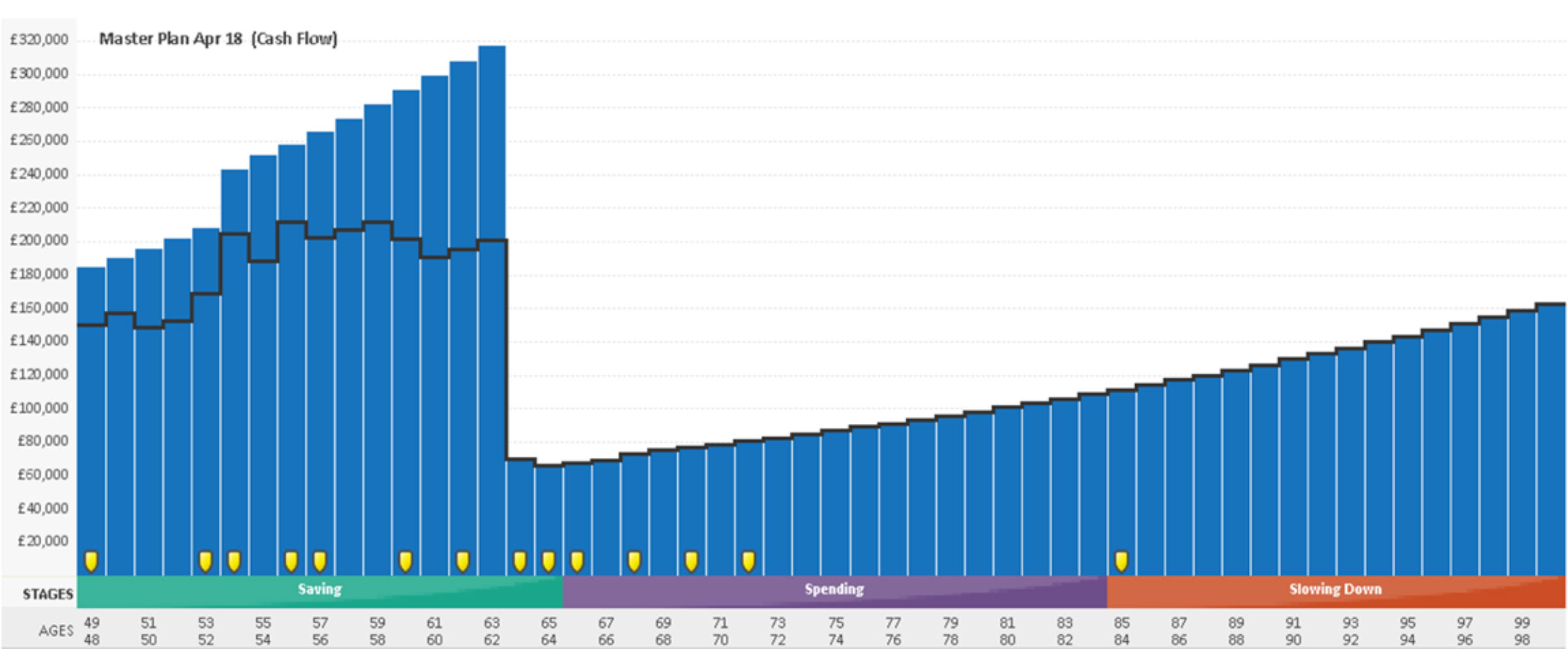

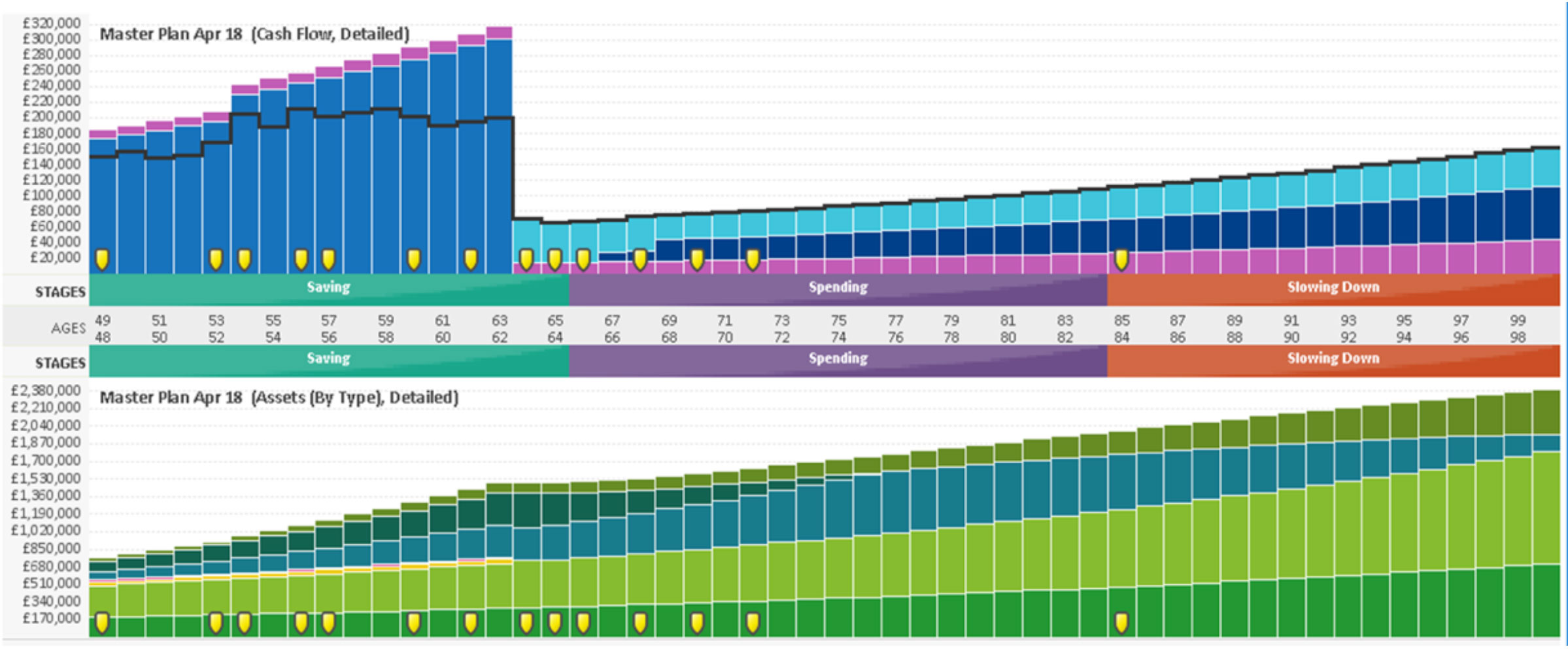

The Master Plan evolves as we work together but will really help to provide clarity as you approach the Spending Period of your life. It will help to remove the guess work and remove the big mistakes that people can easily make. The `Master Plan is entirely fluid and can be amended to match events in your life that try and deviate your plan.

Our clients understand that we can’t foresee stock market highs and lows or which sector or manager to follow, its simply not possible. But we do believe that having a long term view and a clear strategy with good advice at key times will allow you to get a better long term results time that fits your own individual plan and circumstance. The more detail we can build in to your plan, the more real it will become.

To build and work on your plan we use a sophisticated software package. Over and above the Master Plan we agree and build with you, we can also create multiple What If scenarios. This will allow you to plan against certain life events that could potentially derail your overall plan.

How Does It All Work?

We will enter your key details into the software. we will add your income from all sources and review your expenses. We’ll look at your basic expenses and the things you treat yourself with. We will then add your assets, both personal and business, your cash and pension savings and your investments, and finally deduct any liabilities. We can then add to this and update it on an annual basis as part of our review meetings.

By adding events that you want to achieve to your timeline we can start to build your Master Plan. This can help you answer some of the questions many of our clients want to know. For example

– Am I saving enough for my retirement?, – Can I retire early? – Can I work part time and then retire early? – Can I give my daughter a deposit to buy a house – How much more do I need to save to hit my target? – Do I have enough life insurance? – How much should I sell my business for, so that I can live well in retirement? – What income do i need to maintain my lifestyle in retirement?

Some of the key challenges in building these assumptions are in the calculations needed to model inflation, compound investment returns and cash savings return, overlaid with the tax calculations needed. These are all worked in to the system and changed along with changing legislation so we can always run your plans alongside realistic market returns, correct access plans and tax effective disinvestment.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.